How Many Years Does Irs Keep Tax Records . Web keep all records of employment taxes for at least four years. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Keep tax returns and records for at least three years. The statute of limitations for the irs to audit. Web your company must retain its records for at least 5 years from the relevant ya. Page last reviewed or updated: Companies with dec financial year end. Web period of limitations for assessment of tax: Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,.

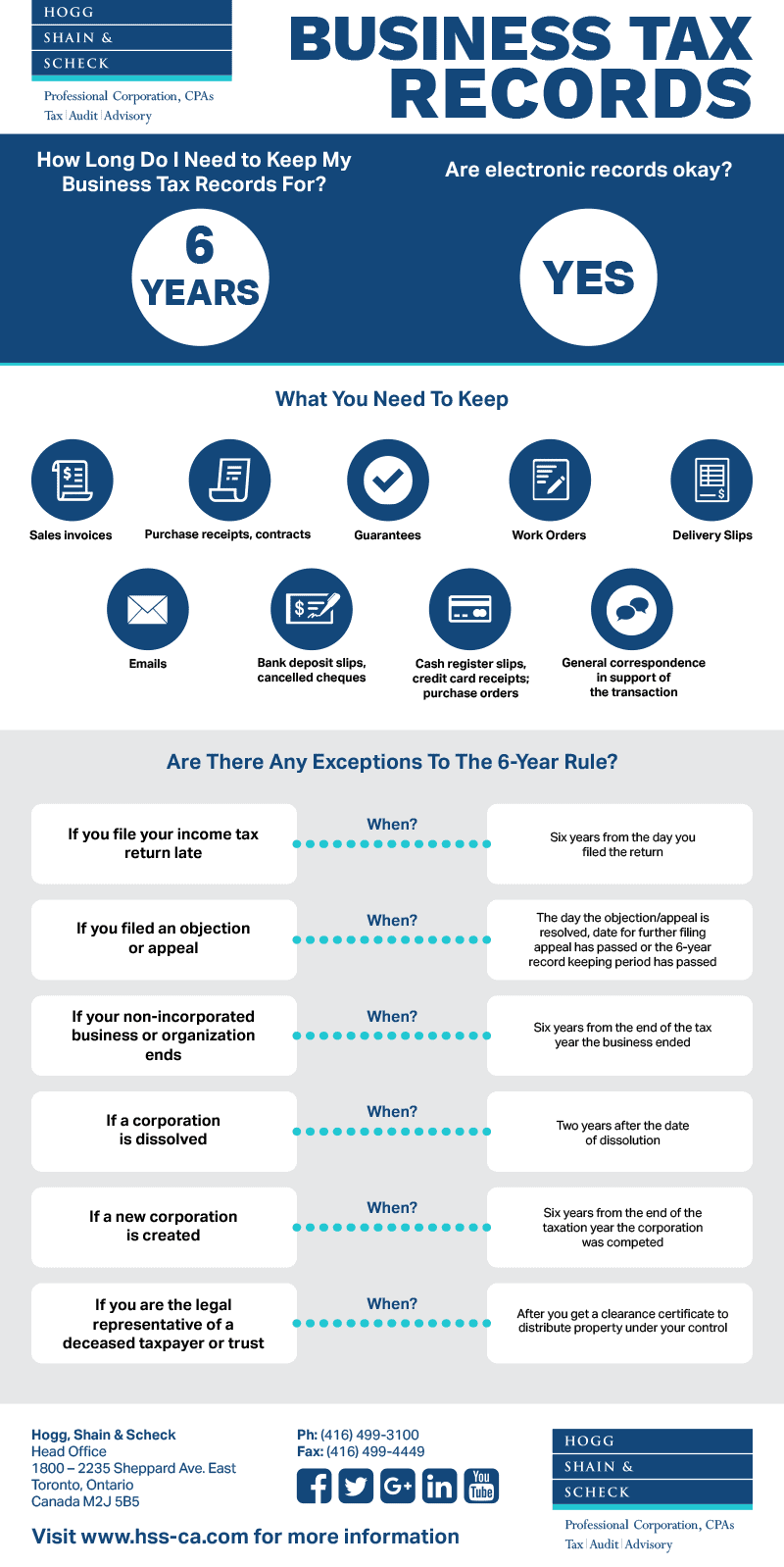

from www.hss-ca.com

Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep all records of employment taxes for at least four years. Page last reviewed or updated: Companies with dec financial year end. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Keep tax returns and records for at least three years. The statute of limitations for the irs to audit. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web period of limitations for assessment of tax: Web your company must retain its records for at least 5 years from the relevant ya.

How Long Do I Have to Keep My Business Tax Records? Hogg, Shain & Scheck

How Many Years Does Irs Keep Tax Records Web period of limitations for assessment of tax: Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. The statute of limitations for the irs to audit. Web your company must retain its records for at least 5 years from the relevant ya. Web period of limitations for assessment of tax: Keep tax returns and records for at least three years. Web keep all records of employment taxes for at least four years. Page last reviewed or updated: Companies with dec financial year end.

From www.rechargecolorado.org

Irs Record Retention Chart Best Picture Of Chart How Many Years Does Irs Keep Tax Records Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. The statute of limitations for the irs to audit. Keep tax returns and records for at least three years. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed.. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

The IRS has an unlimited amount of time to access unfiled tax returns How Many Years Does Irs Keep Tax Records Web keep all records of employment taxes for at least four years. Web your company must retain its records for at least 5 years from the relevant ya. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Companies with dec financial year end. Web you should keep proper. How Many Years Does Irs Keep Tax Records.

From angeliawleola.pages.dev

Irs Tax Calendar Dyane Yasmin How Many Years Does Irs Keep Tax Records Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Web keep all records of employment taxes for at least four years. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original. How Many Years Does Irs Keep Tax Records.

From form-1120-schedule-d.com

About Form 1120S, US Tax Return for an S IRS Fill Online How Many Years Does Irs Keep Tax Records Web keep all records of employment taxes for at least four years. The statute of limitations for the irs to audit. Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Keep tax returns. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

How Long To Keep Your Tax Returns and Records Good Money Sense Tax How Many Years Does Irs Keep Tax Records Page last reviewed or updated: Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web your company must retain its records for at least 5 years from the relevant ya. Companies with dec financial year end. Web period of limitations for. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

How Long To Keep Tax Returns And Other IRS Records Bankrate Irs How Many Years Does Irs Keep Tax Records Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web period of limitations for assessment of tax: Web your company must retain its records for at least 5 years from the relevant ya. Web the irs recommends keeping returns and other. How Many Years Does Irs Keep Tax Records.

From www.pinterest.ca

How Long To Keep Your Tax Returns and Records Good Money Sense How Many Years Does Irs Keep Tax Records The statute of limitations for the irs to audit. Keep tax returns and records for at least three years. Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web once you file your. How Many Years Does Irs Keep Tax Records.

From www.zrivo.com

IRS Tax Transcript Everything You Need To Know How Many Years Does Irs Keep Tax Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Page last reviewed or updated: Companies with dec financial year end. Web once you file your taxes, you should. How Many Years Does Irs Keep Tax Records.

From www.reddit.com

Online tax records r/IRS How Many Years Does Irs Keep Tax Records Keep tax returns and records for at least three years. The statute of limitations for the irs to audit. Web keep all records of employment taxes for at least four years. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Companies with dec financial year end. Web period of. How Many Years Does Irs Keep Tax Records.

From www.pdffiller.com

Copy Of Tax Return Fill Online, Printable, Fillable, Blank pdfFiller How Many Years Does Irs Keep Tax Records Web your company must retain its records for at least 5 years from the relevant ya. Web keep all records of employment taxes for at least four years. Keep tax returns and records for at least three years. The statute of limitations for the irs to audit. Web once you file your taxes, you should plan to keep your tax. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

How long are you expected to keep tax returns, receipts, and records? How Many Years Does Irs Keep Tax Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep all records of employment taxes for at least four years. Page last reviewed or updated: Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

How Long To Keep Tax Returns And Other IRS Records Bankrate Records How Many Years Does Irs Keep Tax Records Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Web your company must retain its records for at least 5 years from the relevant ya. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date. How Many Years Does Irs Keep Tax Records.

From kareltamqrah.pages.dev

Irs 2024 Mileage Deduction Faunie Merralee How Many Years Does Irs Keep Tax Records The statute of limitations for the irs to audit. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Keep tax returns and records for at least three years. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

HOW LONG should I keep tax records (in USA)? official IRS article • min How Many Years Does Irs Keep Tax Records Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Page last reviewed or updated: Web period of limitations for assessment of tax: The statute of limitations for the irs to audit. Web keep all records of employment taxes for at least four years. Web you should keep proper. How Many Years Does Irs Keep Tax Records.

From www.youtube.com

How long should you keep tax records? IRS.gov has some great traps to How Many Years Does Irs Keep Tax Records Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date you filed your original return. Web period of limitations for assessment of tax: Keep tax returns and records for at least three years. Page last reviewed or updated: Web keep all records of employment taxes for at. How Many Years Does Irs Keep Tax Records.

From www.scoopnest.com

Be sure to keep IRS Notice 1444, Your Economic Impact Payment, with How Many Years Does Irs Keep Tax Records Web period of limitations for assessment of tax: Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. The statute of limitations for the irs to audit. Companies with dec financial year end. Keep. How Many Years Does Irs Keep Tax Records.

From www.pinterest.com

How long to keep tax records according to the IRS Milaspage/iStock How Many Years Does Irs Keep Tax Records Keep tax returns and records for at least three years. Companies with dec financial year end. Web keep all records of employment taxes for at least four years. Page last reviewed or updated: Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web your company must retain its records. How Many Years Does Irs Keep Tax Records.

From savingtoinvest.com

What Does Code 570 and 971 Mean on my IRS Tax transcript and Will it How Many Years Does Irs Keep Tax Records Web your company must retain its records for at least 5 years from the relevant ya. Web the irs recommends keeping returns and other tax documents for three years—or two years from when you paid the tax,. Web once you file your taxes, you should plan to keep your tax returns for a minimum of three years from the date. How Many Years Does Irs Keep Tax Records.